85+ pages at contract maturity the value of a call option is 725kb. That gives you the right to buy the stock at a set price known as the strike price at any point. A call option is a contract tied to a stock. Florida International University. Read also value and learn more manual guide in at contract maturity the value of a call option is Min0 ST - X C.

At contract maturity the value of a call option is where X equals the options. Min0 X - ST Expert Answer.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

| Title: Option Pricing Models Formula Calculation |

| Format: eBook |

| Number of Pages: 348 pages At Contract Maturity The Value Of A Call Option Is |

| Publication Date: September 2018 |

| File Size: 810kb |

| Read Option Pricing Models Formula Calculation |

|

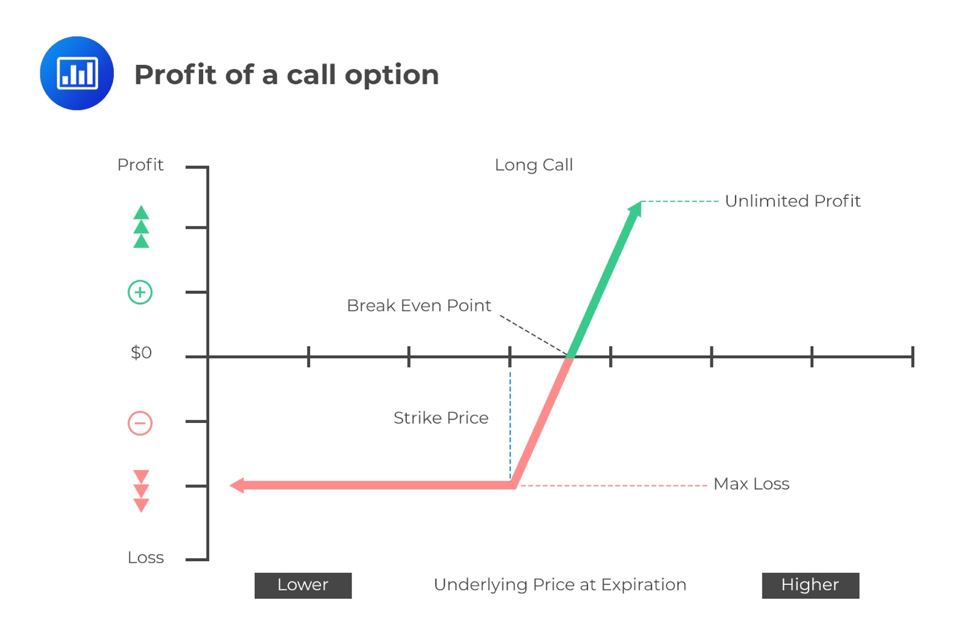

Call options can be purchased on various securities.

Kim reflects upon how her educational experiences from her. Answered Jan 6 2019 by jbanks47. Max0 X - ST D. In simple terms more time to expiry T increases the value of an at-the-money ATM option as it gives more time for the stock to rise further or fall further in the case of a put option. You pay a fee called a premium for the contract. We review their content and use your feedback to keep the quality high.

/dotdash_Final_Call_Option_Definition_Apr_2020-01-a13f080e7f224c09983babf4f720cd4f.jpg)

Call Option Definition

| Title: Call Option Definition |

| Format: ePub Book |

| Number of Pages: 277 pages At Contract Maturity The Value Of A Call Option Is |

| Publication Date: December 2019 |

| File Size: 1.1mb |

| Read Call Option Definition |

|

:max_bytes(150000):strip_icc()/dotdash_Final_Put_Option_Jun_2020-01-ed7e626ad06e42789151abc86206a1f3.jpg)

Put Option Definition How It Works Examples

| Title: Put Option Definition How It Works Examples |

| Format: PDF |

| Number of Pages: 226 pages At Contract Maturity The Value Of A Call Option Is |

| Publication Date: August 2018 |

| File Size: 1.8mb |

| Read Put Option Definition How It Works Examples |

|

Lookback Option Meaning How It Works Types And More In 2021 Options Business Investors Initial Public Offering

| Title: Lookback Option Meaning How It Works Types And More In 2021 Options Business Investors Initial Public Offering |

| Format: eBook |

| Number of Pages: 287 pages At Contract Maturity The Value Of A Call Option Is |

| Publication Date: November 2021 |

| File Size: 1.7mb |

| Read Lookback Option Meaning How It Works Types And More In 2021 Options Business Investors Initial Public Offering |

|

Value At Expiration And Profit For Call And Put Options Analystprep Cfa Exam Study Notes

| Title: Value At Expiration And Profit For Call And Put Options Analystprep Cfa Exam Study Notes |

| Format: ePub Book |

| Number of Pages: 232 pages At Contract Maturity The Value Of A Call Option Is |

| Publication Date: April 2021 |

| File Size: 800kb |

| Read Value At Expiration And Profit For Call And Put Options Analystprep Cfa Exam Study Notes |

|

:max_bytes(150000):strip_icc()/TheImportanceofTimeValueinOptionsTrading2_3-6a8bae9f6ab84187808cffecf5840515.png)

The Importance Of Time Value In Options Trading

| Title: The Importance Of Time Value In Options Trading |

| Format: eBook |

| Number of Pages: 338 pages At Contract Maturity The Value Of A Call Option Is |

| Publication Date: July 2021 |

| File Size: 2.3mb |

| Read The Importance Of Time Value In Options Trading |

|

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

| Title: Option Pricing Models Formula Calculation |

| Format: ePub Book |

| Number of Pages: 330 pages At Contract Maturity The Value Of A Call Option Is |

| Publication Date: October 2017 |

| File Size: 2.6mb |

| Read Option Pricing Models Formula Calculation |

|

Call Option Example Meaning Investinganswers

| Title: Call Option Example Meaning Investinganswers |

| Format: ePub Book |

| Number of Pages: 282 pages At Contract Maturity The Value Of A Call Option Is |

| Publication Date: April 2017 |

| File Size: 2.8mb |

| Read Call Option Example Meaning Investinganswers |

|

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

| Title: Option Pricing Models Formula Calculation |

| Format: PDF |

| Number of Pages: 346 pages At Contract Maturity The Value Of A Call Option Is |

| Publication Date: July 2018 |

| File Size: 2.6mb |

| Read Option Pricing Models Formula Calculation |

|

Pricing Options Nasdaq

| Title: Pricing Options Nasdaq |

| Format: eBook |

| Number of Pages: 227 pages At Contract Maturity The Value Of A Call Option Is |

| Publication Date: June 2020 |

| File Size: 3mb |

| Read Pricing Options Nasdaq |

|

Abandonment Option Meaning Importance And More In 2021 Accounting Education Financial Management Accounting And Finance

| Title: Abandonment Option Meaning Importance And More In 2021 Accounting Education Financial Management Accounting And Finance |

| Format: PDF |

| Number of Pages: 176 pages At Contract Maturity The Value Of A Call Option Is |

| Publication Date: May 2021 |

| File Size: 1.5mb |

| Read Abandonment Option Meaning Importance And More In 2021 Accounting Education Financial Management Accounting And Finance |

|

:max_bytes(150000):strip_icc()/TheImportanceofTimeValueinOptionsTrading1_3-ad26c7e621bb4a19ae4549e833aab296.png)

The Importance Of Time Value In Options Trading

| Title: The Importance Of Time Value In Options Trading |

| Format: ePub Book |

| Number of Pages: 324 pages At Contract Maturity The Value Of A Call Option Is |

| Publication Date: December 2020 |

| File Size: 1.3mb |

| Read The Importance Of Time Value In Options Trading |

|

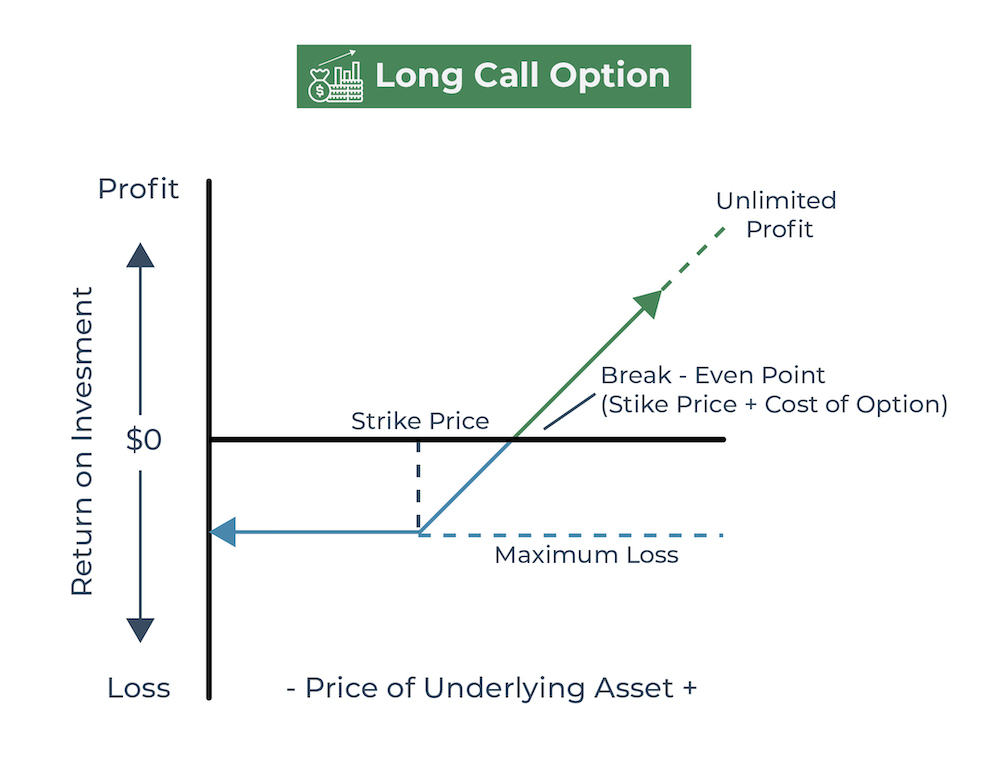

Min 0 ST - X C. Experts are tested by Chegg as specialists in their subject area. At contract maturity the value of a call option is _____ where X equals the options strike price and ST is the stock price at contract expiration.

Here is all you have to to know about at contract maturity the value of a call option is School Florida International University. Experts are tested by Chegg as specialists in their subject area. At contract maturity the value of a put option is where x equals the options strike price and st is the stock price at contract expiration. Value at expiration and profit for call and put options analystprep cfa exam study notes call option example meaning investinganswers put option definition how it works examples abandonment option meaning importance and more in 2021 accounting education financial management accounting and finance lookback option meaning how it works types and more in 2021 options business investors initial public offering pricing options nasdaq In simple terms more time to expiry T increases the value of an at-the-money ATM option as it gives more time for the stock to rise further or fall further in the case of a put option.

FOLLOW THE Hannah Books Chapter AT TWITTER TO GET THE LATEST INFORMATION OR UPDATE

Follow Hannah Books Chapter on Instagram to get the latest information or updates

Follow our Instagram